|

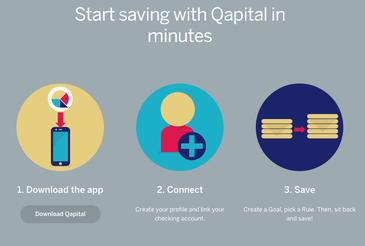

Something that many people have told me that they struggle with is handling money, which just so happens to be something that I'm fairly good at. So for this week's blog, I'm going to share some tips and methods to saving money and making sure you are able to pay your bills, save for the future, and have a money left over for fun activities or a rainy day. 1. Open Multiple Savings Accounts The main two savings accounts that I recommend for anyone is a general savings (for emergency money or to save for a general goal) and a trip/ rainy day savings (for travelling, attending concerts, other fun events, and to reward yourself when you're in need of a fun reminder). Personally I have three savings- general, trip, and college. If you're in college, I 100% recommend having an account, especially if you have student loans. Even if you add just a little amount every week, it will add up and help pay those loans back. You can also make an account for anything that you feel you need. And if it's a smaller goal that you don't think deems necessary to open up an actual account, then keep a box or jar in your room. The key to this is depositing money in the same way that you would an account. 2. Open Retirement Accounts Many jobs offer 401K's for their employers. This takes a small amount out of each paycheck and saves it into an account for you to use that money for retirement and potentially large life events- like buying a house. But if you're in college or just working part time jobs or jobs that don't offer 401K's you have the option to open a Roth IRA. I recommend that everyone have both a Roth and a 401K because in the end you'll end up with more money. A Roth essentially does the same thing but you can choose the amount you want to be taken out of your normal checking account monthly and set up autopay. 3. Set Up Auto-Transfers and Make Saving a Habit I know people say this a lot, but every penny counts. Even if you only save 10% of your paycheck it all starts to add up. When you have multiple savings and retirement accounts you'll be surprised how fast your money grows. When possible, it makes it much easier to set up an autotransfer on your accounts. The less steps you have to do after setting it up, the easier and more effortless it is to save money. Like I mentioned with the box/ jar before, if you're saving cash then make sure to save just as religiously as your accounts are set up. Now this doesn't have to be an extravagant amount of money every time you add to your savings. Put whatever amount you can. You should have an idea of how much money you can afford to put away so try to stick to that amount every paycheck/ week/ month (the consistency is totally up to you. I tend to put money away every paycheck and my Roth is set up to take money every month). But if you have a smaller paycheck then don't feel bad if you can't put in the full amount. Just put aside what you can because it stills adds up. And if you get extra money or birthday/ holiday gift money then add a little more to that savings. When you have multiple savings make sure to try to add to all of them consistently. Once you decide how much you can put into savings total, then split up that total into the different goals accordingly. Maybe one savings gets more than the others. That's 100% acceptable. 4. Make an Excel Sheet with All of Your Bills Make a list of all of your monthly bills, the day of the month the bill is due, and how much the bill costs. When you start the excel sheet, the first column should be the day the bill is due, the second put the description of the bill, and then the third the price of the bill. In between the bills, add the days that you are getting paid and then the estimate of how much will be on your paycheck. Autosum the down the third column of prices and see how much you have left over at the end of the month. Besides bills like rent, water, gas and electric, and subscriptions, you should also include an estimate of how much you spend on food every month, the amount you plan to put into savings, a buffer amount for miscellaneous expenses, and add any extra costs you know you will have to pay that month (like renewing your license, vehicle registration, a ticket for a concert you plan on attending). When you have your monthly list made, you can copy and paste it onto different sheets that you can organize month by month. Copying and pasting makes your life easier for the following months and the more you check and update your sheet, the more control you'll have over your finances and the easier monitoring your money becomes. This sheet helps you by seeing how much you need to have by certain dates, how much money you have and what you can afford to do as far as shopping, travelling, etc. 5. Download Saving Apps to Help Monitor and Save The two apps that I use the most to help me in my saving is Qapital and Mint. Mint is very helpful to monitor. Essentially this can do the same thing as the excel sheet. You can add your bills and their due date, link your checking, savings and retirement accounts, and the app will show you how much your spending and where that money is going. It also gives you tips on saving, what to avoid spending money on, and also credit card/ credit options that fit your life and spending habits. Qapital is an app that you link to your checking account. You can make rules that helps you save into your Qapital account. I applied the round up rule which basically rounds up my purchases to the nearest dollar. This doesn't sound like a lot of money at first when you see that it's only a couple cents for each purchase, but when you keep the app going a while and don't have to pay attention to it, the money that adds up will definitely surprise you. If you want to download Qapital, use my referral link to get $5 after your first deposit via rule you set up: https://get.qapital.com/1aHRIEsKoT . 6. Building Credit with Credit Cards

Everyone needs good credit but that requires that you build it up. The fastest way I started building my credit is by getting multiple credit cards. I got one through my bank and then two retail cards for Victoria's Secret and Forever 21. A lot of people don't recommend this because it's easy to get into debt. But the key to making this work is making sure you have the money in cash or your checking account before using your credit card. What do I mean exactly? Well, when you go into a store you should be shopping because you know you have the money for it regardless. So purchase your item with your credit card. Wait until the amount posts to the card and then pay that amount off right away. You're avoiding paying interest by paying it off before the month passes and you're also building up your credit by using the card responsibly. You don't want to use a large percent of your credit limit, but if it starts getting up there and you can't pay the full amount off at once, then calculate how much you can spend monthly on the card, don't use it for any additional purposes until you clear the amount, and ensure that you pay it off little by little every month. I use Credit Karma to check on my credit score. It's a great app to get an idea of where you're at and it also provides tips on how to build and improve your credit. However it doesn't give you an exact score so don't be too dependent on what the score is telling you. It typically only varies by a few points either higher or lower but for the most part it is a reliable resource. These are the main tips that I live by. Be sure to take the time to play with these methods so they best fit your life and financial situation. I hope this helps and if you have any questions, you can always reach out. Also share the money saving methods that you live by. The more we help each other, the more success that we'll all have! Sincerely, Alana

0 Comments

Leave a Reply. |

Categories

All

AuthorSince I was a little girl, writing was always my go- to way of expressing myself and escaping from the rest of the world. |